Your Ali baba ipo lead underwriters images are available in this site. Ali baba ipo lead underwriters are a topic that is being searched for and liked by netizens today. You can Download the Ali baba ipo lead underwriters files here. Download all free photos.

If you’re searching for ali baba ipo lead underwriters images information connected with to the ali baba ipo lead underwriters topic, you have visit the ideal site. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Ali Baba Ipo Lead Underwriters. Listing give years ago when the company took in a record 25 billion. YHOO has an approximately 225 stake has chosen Barclays PLC BCS as the lead underwriter for its Initial Public Offering IPO. Learn how you can invest in the private market and buy shares before companies go public. Six firms were listed as Alibabas lead underwriters listed mostly in alphabetical order.

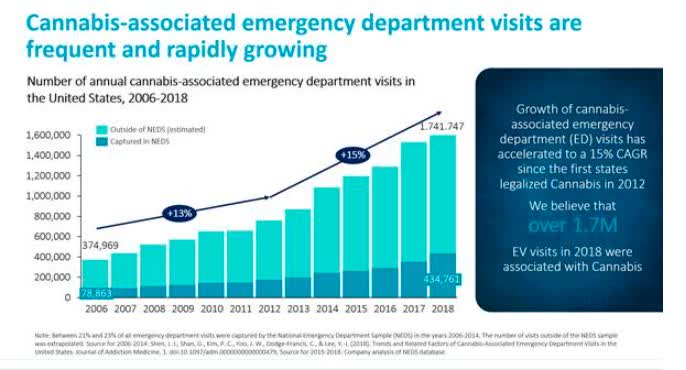

Anebulo Pharma Seeks To Raise 21m In Ipo Seeking Alpha From seekingalpha.com

Anebulo Pharma Seeks To Raise 21m In Ipo Seeking Alpha From seekingalpha.com

Anuncio Alibaba Offers a Wide Range of Ready-to-ship Products for Your Next Event. Anuncio The Private Market is Where the Best Investments Are. Search find Now. Alibaba on its listing on the New York Stock Exchange NYSE on 19 September 2014. Anuncio Search For Alibaba. BOCI Asia Ltd China International Capital Corp Hong Kong Securities Ltd CLSA.

Listing give years ago when the company took in a record 25 billion.

The following is the list of Alibabas banking syndicate. The four banks that are underwriting that loan and also are lead bookrunners on Alibabas IPO are Citigroup Inc Deutsche Bank AG JP. Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and. YHOO has an approximately 225 stake has chosen Barclays PLC BCS as the lead underwriter for its Initial Public Offering IPO. Learn Why Inside Now. King Wood Mallesons advises on Alibabas IPO.

Source: pinterest.com

Source: pinterest.com

This year the company hired an unheard-of six lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JP Morgan Chase Morgan Stanley and Citigroup to help plan the underwriting. Credit Suisse was one of a raft of lead underwriters for Alibabas US. King Wood Mallesons advises on Alibabas IPO. Learn how you can invest in the private market and buy shares before companies go public. Listing give years ago when the company took in a record 25 billion.

Source: livemint.com

Source: livemint.com

If the Hong Kong listing takes in the 20 billion it aims to it will make for the largest IPO since 2010 Bloomberg reported. Following the decision by Alibabas lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and Citigroup the total deal size rose to 3681 million shares up from 3201 million shares previously. Six firms were listed as Alibabas lead underwriters listed mostly in alphabetical order. Anuncio Alibaba Offers a Wide Range of Ready-to-ship Products for Your Next Event. Alibaba on its listing on the New York Stock Exchange NYSE on 19 September 2014.

Source: independent.co.uk

Source: independent.co.uk

The four banks that are underwriting that loan and also are lead bookrunners on Alibabas IPO are Citigroup Inc Deutsche Bank AG JP. King Wood Mallesons advises on Alibabas IPO. Reporting by Echo Wang in New York and Anirban Sen in. YHOO has an approximately 225 stake has chosen Barclays PLC BCS as the lead underwriter for its Initial Public Offering IPO. The four banks that are underwriting that loan and also are lead bookrunners on Alibabas IPO are Citigroup Inc Deutsche Bank AG JP.

Source: statista.com

Source: statista.com

Credit Suisse was one of a raft of lead underwriters for Alibabas US. The banks are expected to share to in an underwriting fee of about 1 percent according to people with knowledge of the deal or just over 200 million if the stock sale prices at the high end. Anuncio Search For Alibaba. Alibaba IPO underwriters earn 300 million in fees 12 percent of deal Alibabas Jack Ma had agreed under the same option to sell an extra 27 million shares and company co-founder Joe Tsai. Anuncio The Private Market is Where the Best Investments Are.

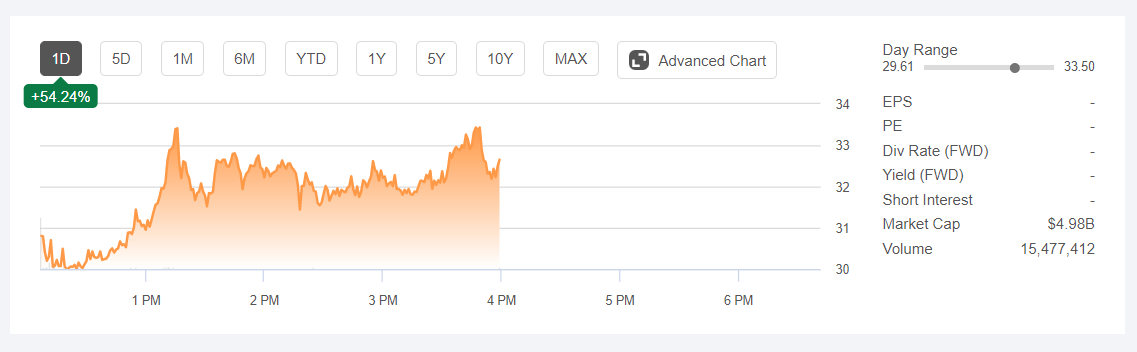

Source: seekingalpha.com

Source: seekingalpha.com

Anuncio The Private Market is Where the Best Investments Are. Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and. This year the company hired an unheard-of six lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JP Morgan Chase Morgan Stanley and Citigroup to help plan the underwriting. Following the decision by Alibabas lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and Citigroup the total deal size rose to 3681 million shares up from 3201 million shares previously. Anuncio Alibaba Offers a Wide Range of Ready-to-ship Products for Your Next Event.

Source: in.pinterest.com

Source: in.pinterest.com

Six firms were listed as Alibabas lead underwriters listed mostly in alphabetical order. Anuncio Search For Alibaba. BOCI Asia Ltd China International Capital Corp Hong Kong Securities Ltd CLSA. This year the company hired an unheard-of six lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JP Morgan Chase Morgan Stanley and Citigroup to help plan the underwriting. Morgan are the lead underwriters for the IPO.

Source: statista.com

Source: statista.com

Anuncio The Private Market is Where the Best Investments Are. King Wood Mallesons advised the lead underwriters for Alibaba Group Holding Ltd. Goldman Sachs Morgan Stanley and JP. Learn Why Inside Now. Search find Now.

Credit Suisse Securities USA LLC. Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and. Alibaba IPO underwriters earn 300 million in fees 12 percent of deal Alibabas Jack Ma had agreed under the same option to sell an extra 27 million shares and company co-founder Joe Tsai. King Wood Mallesons advised lead underwriters for Alibaba on its successful listing on the New York Stock Exchange. Anuncio The Private Market is Where the Best Investments Are.

Source: fortune.com

Source: fortune.com

Learn Why Inside Now. Credit Suisse Securities USA LLC Deutsche Bank Securities Inc Goldman Sachs Asia LLC JP Morgan Securities LLC Morgan Stanley Co International Plc Citigroup Global Markets Inc OTHER UNDERWRITERS. King Wood Mallesons advised lead underwriters for Alibaba on its successful listing on the New York Stock Exchange. King Wood Mallesons advised the lead underwriters for Alibaba Group Holding Ltd. Learn how you can invest in the private market and buy shares before companies go public.

Source: statista.com

Source: statista.com

Alibaba IPO underwriters earn 300 million in fees 12 percent of deal Alibabas Jack Ma had agreed under the same option to sell an extra 27 million shares and company co-founder Joe Tsai. This year the company hired an unheard-of six lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JP Morgan Chase Morgan Stanley and Citigroup to help plan the underwriting. Listing give years ago when the company took in a record 25 billion. Anuncio Search For Alibaba. Credit Suisse Securities USA LLC.

Source: bloombergquint.com

Source: bloombergquint.com

Learn how you can invest in the private market and buy shares before companies go public. Learn how you can invest in the private market and buy shares before companies go public. Learn Why Inside Now. BOCI Asia Ltd China International Capital Corp Hong Kong Securities Ltd CLSA. In this IPO Alibaba sold more than 320 million American Depository Shares ADS at the price of US68 per ADS raising approximately.

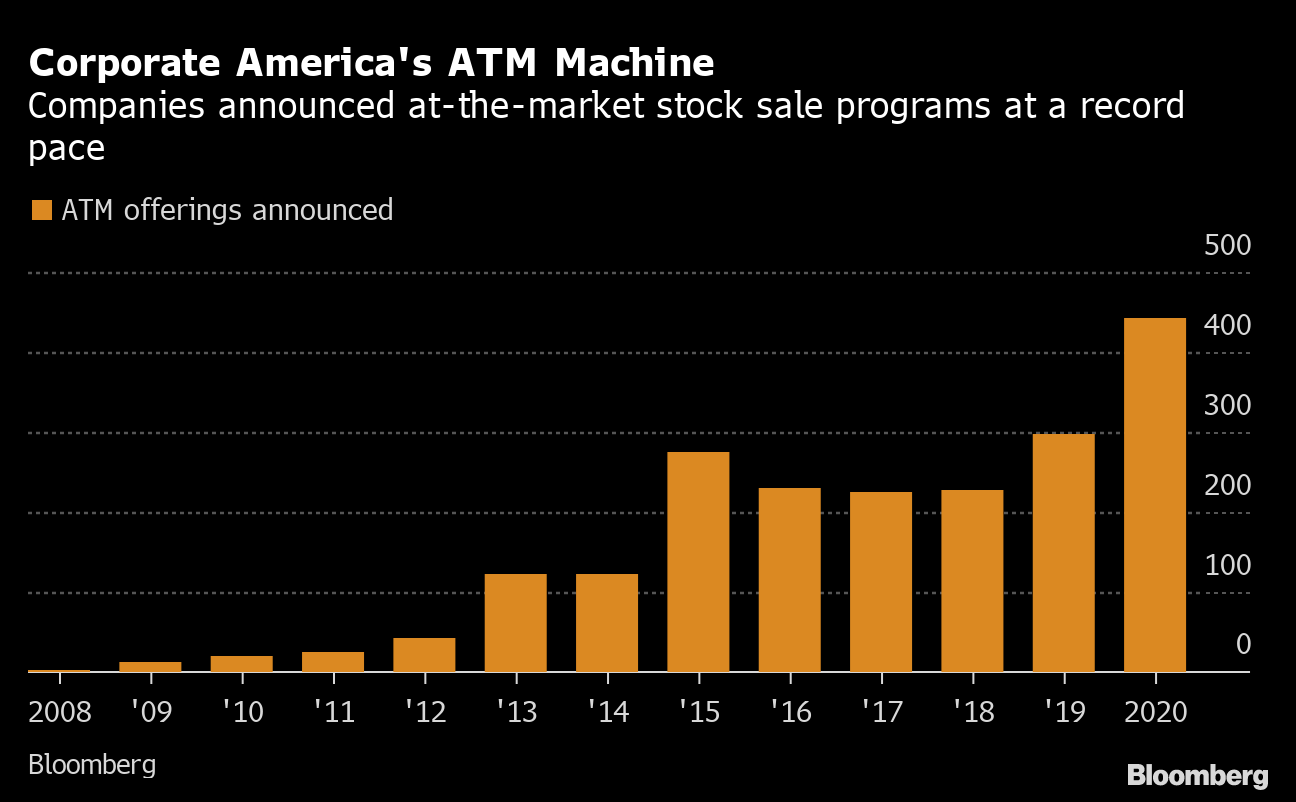

Source: bloomberg.com

Source: bloomberg.com

King Wood Mallesons advised the lead underwriters for Alibaba Group Holding Ltd. Credit Suisse Securities USA LLC. King Wood Mallesons advised the lead underwriters for Alibaba Group Holding Ltd. Anuncio Search For Alibaba. Morgan are the lead underwriters for the IPO.

King Wood Mallesons advised the lead underwriters for Alibaba Group Holding Ltd. Credit Suisse was one of a raft of lead underwriters for Alibabas US. Learn how you can invest in the private market and buy shares before companies go public. Anuncio The Private Market is Where the Best Investments Are. If the Hong Kong listing takes in the 20 billion it aims to it will make for the largest IPO since 2010 Bloomberg reported.

Source: bloombergquint.com

Source: bloombergquint.com

Listing give years ago when the company took in a record 25 billion. Following the decision by Alibabas lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and Citigroup the total deal size rose to 3681 million shares up from 3201 million shares previously. The following is the list of Alibabas banking syndicate. If the Hong Kong listing takes in the 20 billion it aims to it will make for the largest IPO since 2010 Bloomberg reported. Six firms were listed as Alibabas lead underwriters listed mostly in alphabetical order.

Source: ft.com

Learn how you can invest in the private market and buy shares before companies go public. The banks are expected to share to in an underwriting fee of about 1 percent according to people with knowledge of the deal or just over 200 million if the stock sale prices at the high end. If the Hong Kong listing takes in the 20 billion it aims to it will make for the largest IPO since 2010 Bloomberg reported. Anuncio Search For Alibaba. Credit Suisse Securities USA LLC Deutsche Bank Securities Inc Goldman Sachs Asia LLC JP Morgan Securities LLC Morgan Stanley Co International Plc Citigroup Global Markets Inc OTHER UNDERWRITERS.

Source: dealbook.nytimes.com

Source: dealbook.nytimes.com

Anuncio Alibaba Offers a Wide Range of Ready-to-ship Products for Your Next Event. Anuncio Alibaba Offers a Wide Range of Ready-to-ship Products for Your Next Event. Anuncio Search For Alibaba. Credit Suisse was one of a raft of lead underwriters for Alibabas US. Reporting by Echo Wang in New York and Anirban Sen in.

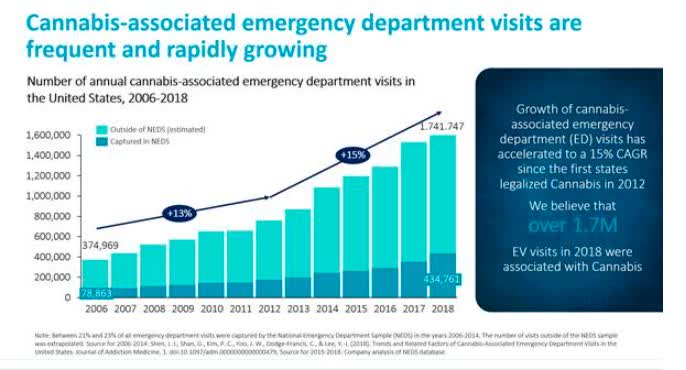

Source: seekingalpha.com

Source: seekingalpha.com

Chase Co and Morgan Stanley. Learn Why Inside Now. The banks are expected to share to in an underwriting fee of about 1 percent according to people with knowledge of the deal or just over 200 million if the stock sale prices at the high end. Goldman Sachs Morgan Stanley and JP. Learn how you can invest in the private market and buy shares before companies go public.

Source: zdnet.com

Source: zdnet.com

Listing give years ago when the company took in a record 25 billion. Learn how you can invest in the private market and buy shares before companies go public. The banks are expected to share to in an underwriting fee of about 1 percent according to people with knowledge of the deal or just over 200 million if the stock sale prices at the high end. Credit Suisse Deutsche Bank Goldman Sachs JPMorgan Chase Morgan Stanley and. This year the company hired an unheard-of six lead underwriters Credit Suisse Deutsche Bank Goldman Sachs JP Morgan Chase Morgan Stanley and Citigroup to help plan the underwriting.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ali baba ipo lead underwriters by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.