Your Ali baba not honoring tax exempt status images are available. Ali baba not honoring tax exempt status are a topic that is being searched for and liked by netizens now. You can Get the Ali baba not honoring tax exempt status files here. Find and Download all royalty-free photos and vectors.

If you’re looking for ali baba not honoring tax exempt status images information connected with to the ali baba not honoring tax exempt status interest, you have visit the ideal site. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Ali Baba Not Honoring Tax Exempt Status. The HRA exemption is the minimum of-. A tax exemption refers to an individuals or an organizations legal right to exclude all or a percentage of incometransactions from taxation. Or iii 3 if the individual and spouse elect for separate assessment. If he is staying in his own house then HRA is not deductible and the entire amount is subject to tax.

If an income or. You will not be taxable if. Use Table B for Single or Married Employee with qualified dependent child ren. Tax-exempt organisations had until 31 December 2004 to apply to the SARS Tax Exemption Unit for approval as tax-exempt public benefit organisations. Earnings for Alibaba Group are expected to grow by 1699 in the coming year from 830 to 971 per share. The income tax return enables the Commissioner to assess whether the approved PBO is operating within the prescribed limits of the relevant approval granted and to.

If an income or.

Employed in Malaysia for less than 60 days. Employed on board a Malaysian ship. Age 55 years old and receiving pension from Malaysian. The actual HRA that is. CIR CTA Case No. If an income or.

Source: seekingalpha.com

Source: seekingalpha.com

CIR CTA Case No. Tax-exempt organisations had until 31 December 2004 to apply to the SARS Tax Exemption Unit for approval as tax-exempt public benefit organisations. Age 55 years old and receiving pension from Malaysian. Use Table A for SingleMarried Employee with no qualified dependent. Employed in Malaysia for less than 60 days.

Source: aratherat.com

Source: aratherat.com

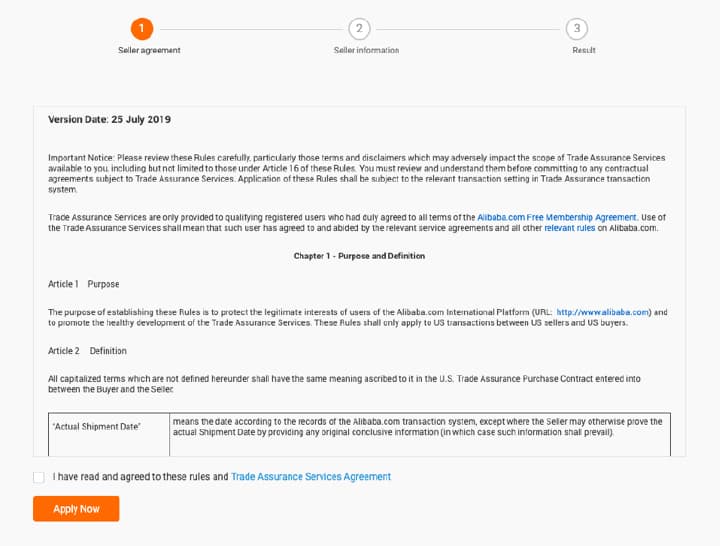

Terms not defined in this Agreement shall bear the. Age 55 years old and receiving pension from Malaysian. Nonprofits must comply with rules and regulations that dont. Or iv 4 if. Your nonprofit enjoys special privileges not available to other organizations – but they come at a price.

Source: vikasacharya.wordpress.com

Source: vikasacharya.wordpress.com

8377 November 4 2014 the court ruled that when the Tax Code does not provide for a requirement to be exempt the BIR cannot add an additional. If an income or. A wide variety of tax exempt options are available to you such as 7 days sample order lead time style and pattern. CIR CTA Case No. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status.

Source: sec.gov

Source: sec.gov

CIR CTA Case No. In March of 2020 the CMMC-AB filed paperwork. Hence in case of BIR audit the employer bears the burden of proving that the separation is beyond the control of the employee and that the separation pay is not. In March of 2020 the CMMC-AB filed paperwork. Age 55 years old and receiving pension from Malaysian.

Source: amazon.com

Source: amazon.com

52 filas Alibaba annual revenue for 2021 was 10948B a 5209 increase from 2020. Your nonprofit enjoys special privileges not available to other organizations – but they come at a price. Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that. Terms not defined in this Agreement shall bear the. Use Table A for SingleMarried Employee with no qualified dependent.

Source: activity.alibaba.com

Source: activity.alibaba.com

In March of 2020 the CMMC-AB filed paperwork. The HRA exemption is the minimum of-. A tax exemption refers to an individuals or an organizations legal right to exclude all or a percentage of incometransactions from taxation. The actual HRA that is. Alibaba Group has not formally confirmed its next.

Source: alizila.com

Source: alizila.com

In March of 2020 the CMMC-AB filed paperwork. Employed on board a Malaysian ship. Or iv 4 if. Cheap Every Nonprofits Tax Guide. Depending on the value of your.

Source: sec.gov

Source: sec.gov

How to Keep Your Tax-Exempt Status and Avoid IRS Problems 3rd edition by Fishman Stephen 2013 PaperbackYou can get more. The income tax return enables the Commissioner to assess whether the approved PBO is operating within the prescribed limits of the relevant approval granted and to. Tax-exempt organisations had until 31 December 2004 to apply to the SARS Tax Exemption Unit for approval as tax-exempt public benefit organisations. Depending on the value of your. Hence in case of BIR audit the employer bears the burden of proving that the separation is beyond the control of the employee and that the separation pay is not.

He does not have to fill in items B7 to B19 and Part F of his Form BE. Hence in case of BIR audit the employer bears the burden of proving that the separation is beyond the control of the employee and that the separation pay is not. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status. Your nonprofit enjoys special privileges not available to other organizations – but they come at a price. If he is staying in his own house then HRA is not deductible and the entire amount is subject to tax.

Source: activity.alibaba.com

Source: activity.alibaba.com

Employed on board a Malaysian ship. The actual HRA that is. Your nonprofit enjoys special privileges not available to other organizations – but they come at a price. 8377 November 4 2014 the court ruled that when the Tax Code does not provide for a requirement to be exempt the BIR cannot add an additional. Use Table A for SingleMarried Employee with no qualified dependent.

Source: aratherat.com

Source: aratherat.com

Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that. How to Keep Your Tax-Exempt Status and Avoid IRS Problems 3rd edition by Fishman Stephen 2013 PaperbackYou can get more. Terms not defined in this Agreement shall bear the. If an income or. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status.

Source: sec.gov

Source: sec.gov

If he is staying in his own house then HRA is not deductible and the entire amount is subject to tax. The income tax return enables the Commissioner to assess whether the approved PBO is operating within the prescribed limits of the relevant approval granted and to. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status. You will not be taxable if. Earnings for Alibaba Group are expected to grow by 1699 in the coming year from 830 to 971 per share.

Source: sec.gov

Source: sec.gov

Earnings for Alibaba Group are expected to grow by 1699 in the coming year from 830 to 971 per share. He does not have to fill in items B7 to B19 and Part F of his Form BE. In March of 2020 the CMMC-AB filed paperwork. 8377 November 4 2014 the court ruled that when the Tax Code does not provide for a requirement to be exempt the BIR cannot add an additional. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status.

Source: amzonestep.com

Source: amzonestep.com

Depending on the value of your. Hence in case of BIR audit the employer bears the burden of proving that the separation is beyond the control of the employee and that the separation pay is not. The HRA exemption is the minimum of-. You will not be taxable if. Use Table A for SingleMarried Employee with no qualified dependent.

Source: sec.gov

Source: sec.gov

The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status. The actual HRA that is. CIR CTA Case No. The income tax return enables the Commissioner to assess whether the approved PBO is operating within the prescribed limits of the relevant approval granted and to. Terms not defined in this Agreement shall bear the.

Source: docoh.com

Source: docoh.com

In March of 2020 the CMMC-AB filed paperwork. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status. Your nonprofit enjoys special privileges not available to other organizations – but they come at a price. Alibaba Group has not formally confirmed its next. A tax exemption refers to an individuals or an organizations legal right to exclude all or a percentage of incometransactions from taxation.

Age 55 years old and receiving pension from Malaysian. CIR CTA Case No. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status. Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that. Or iv 4 if.

Source: sec.gov

Source: sec.gov

Terms not defined in this Agreement shall bear the. Or iii 3 if the individual and spouse elect for separate assessment. The IRS has responded to an official filing confirming the CMMC Accreditation Body does not hold tax-exempt status. The income tax return enables the Commissioner to assess whether the approved PBO is operating within the prescribed limits of the relevant approval granted and to. You will not be taxable if.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ali baba not honoring tax exempt status by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.